The regulatory clock is ticking. With the EU AI Act’s high-risk systems deadline seven months away and FINMA’s Communication 08/2024 now in force, 2026 marks a decisive moment for AI governance in Swiss financial services, insurance, and biopharma. Organizations that treated governance as a compliance checkbox in 2025 are discovering a harsh reality: without robust frameworks, AI initiatives either fail to deliver value or expose the enterprise to unacceptable risk. See below what it will mean for AI governance Switzerland in 2026.

The data tells a compelling story. Swiss organizations lead Europe in AI adoption, with 52% now using AI agents to automate business processes—significantly ahead of the 46% global average. Yet this acceleration creates a dangerous paradox: 80% of organizations show signs of Shadow AI activity, with employees using unapproved tools that bypass governance entirely. Meanwhile, Gartner projects that 60% of AI projects will miss their value targets by 2027 due to inadequate governance structures.

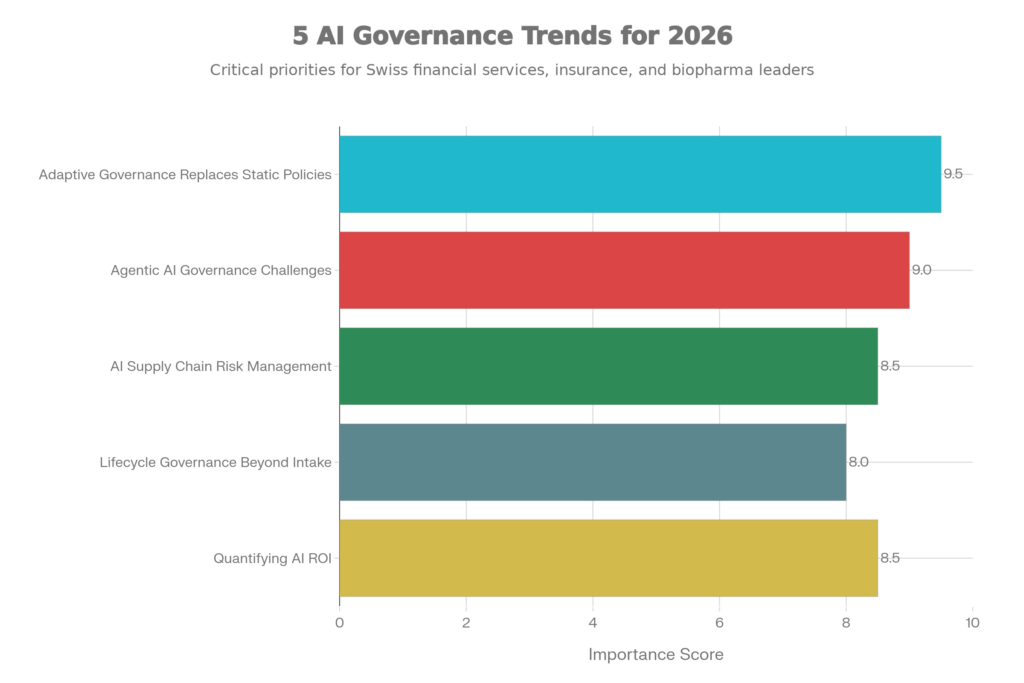

For Swiss banking, insurance, and biopharma executives navigating this landscape, five critical trends will separate leaders from laggards in 2026.

Trend 1: Adaptive Governance Replaces Static Policies

The annual policy review is dead. When AI models evolve weekly and new tools proliferate daily, organizations can no longer rely on static governance frameworks updated once a year.

What it means for Swiss institutions: FINMA’s guidance emphasizes systematic risk identification and ongoing monitoring. Banks and insurers must move beyond approval gates to implement dynamic frameworks that adapt as models retrain, data sources change, and regulatory requirements evolve. The question is no longer “Did we review this model last quarter?” but “Do we have real-time visibility into what this model is doing right now?”

Trend 2: Agentic AI Governance Challenges

Autonomous AI agents capable of independent decision-making represent the next frontier—and the next governance nightmare. Gartner predicts that 15% of day-to-day work decisions will be made autonomously by AI systems by 2028. These aren’t simple automation scripts; they’re agents that perceive environments, make decisions, and take actions without human intervention.

The governance challenge is fundamental: traditional frameworks assume humans remain in the decision loop. Agentic AI explicitly removes that assumption. When an AI agent autonomously executes a trade, approves a claim, or adjusts a drug dosage recommendation, who is accountable? How do you audit decisions made by systems designed to operate independently?

What it means for Swiss institutions: The question regulators will ask isn’t whether you use agentic AI—it’s whether you can explain, audit, and control what those systems do. FINMA’s emphasis on explainability and independent audits becomes exponentially more complex when the system being audited doesn’t just recommend but acts.

Trend 3: AI Supply Chain Risk Goes End-to-End

Third-party AI risk is no longer limited to the vendor you contract with directly. Every pretrained model, API endpoint, outsourced labeling service, and upstream dataset introduces supply chain risk that must be governed with the same rigor as internal systems.

What it means for Swiss institutions: FINMA’s guidance makes clear that financial institutions cannot outsource accountability. Banks and insurers must trace AI model provenance, understand what data trained external systems, and continuously monitor third-party AI performance. EIOPA’s insurance framework reinforces this principle: insurers retain full responsibility for AI models, whether internally developed or externally sourced.

For biopharma companies navigating FDA requirements alongside EU AI Act obligations, supply chain governance extends to every AI tool touching drug development, clinical trials, or manufacturing quality control.

Trend 4: Governance Beyond Intake

Too many organizations treat AI governance as an approval gate: submit a request, receive permission, deploy. This intake-focused model fails because it ignores what happens after deployment—where the real risks materialize.

Comprehensive lifecycle governance manages AI systems from initial design through production monitoring and eventual retirement. It integrates with MLOps workflows, tracks model performance drift, monitors for bias emergence over time, and ensures models are decommissioned properly when they become obsolete.

What it means for Swiss institutions: The 93% of Swiss AI adopters reporting revenue increases face a critical question: are those gains sustainable, or will they evaporate when models degrade, data distributions shift, or regulations tighten? Lifecycle governance is the difference between temporary pilots and durable competitive advantage.

Banking applications illustrate the stakes. A credit scoring model approved based on historical data may gradually become biased as economic conditions change and training data becomes less representative. Without continuous monitoring and revalidation, financial institutions deploy models that violate fairness requirements—often without realizing it until regulatory action or customer complaints surface the problem.

Trend 5: Quantifying AI ROI

The pilot phase is over. With AI adoption surging from less than 5% of enterprises in 2023 to a projected 80% by 2026, the question has shifted from “Should we experiment with AI?” to “Are our AI investments delivering measurable returns?”

Organizations that cannot demonstrate clear ROI face budget cuts and strategic pivots. Those that can quantify impact unlock continued investment and executive support. The data shows dramatic variance: UK companies using AI report 152% more revenue and £9 million in additional annual earnings compared to non-adopters. Yet 60% of AI projects will miss their value targets.

What it means for Swiss institutions: The 82% of Swiss AI adopters reporting transformative productivity gains and 35% average revenue increases have a governance advantage—they can measure impact. But measurement requires infrastructure: KPIs tracking model performance, fairness metrics, operational efficiency gains, cost reductions, and customer satisfaction improvements.

Biopharma provides a compelling example: 25% of companies report AI-driven cost reductions and revenue increases of at least 5%. These results come from organizations that embedded ROI measurement into governance frameworks from the start, not as an afterthought.

The Governance Imperative: From Burden to Enabler

These five trends converge on a central insight: governance is no longer a constraint on innovation—it’s the foundation that enables it. Organizations with robust frameworks deploy AI faster, with greater confidence, and with measurably better outcomes than those treating governance as an afterthought.

The regulatory environment reinforces this reality. FINMA’s guidance, the EU AI Act’s August deadline, and EIOPA’s insurance framework create a compliance floor that every institution must meet. But the ceiling—the competitive advantage—belongs to organizations that view governance as strategic capability, not regulatory burden.

The Swiss advantage is real but fragile. At 52% adoption of AI agents and 48% year-over-year growth in AI usage, Swiss organizations lead Europe. Yet 80% of companies show Shadow AI activity, 60% cannot monitor what employees submit to AI tools, and 40% of enterprises will experience Shadow AI breaches by 2030. Leadership without governance is a race toward preventable failure.

Where to Begin :

For banking, insurance, and biopharma leaders confronting these trends, the path forward requires four foundational steps:

1. Assess your governance maturity. Where do you fall on the spectrum from ad-hoc policies to adaptive, lifecycle-integrated frameworks? Most Swiss organizations remain in early stages despite high adoption rates.

2. Close the Shadow AI gap. The 78% of AI users bringing their own tools to work represent both immediate risk and unrealized potential. Create sanctioned alternatives that meet employee needs while maintaining institutional controls.

3. Establish cross-functional governance committees. The most effective frameworks bring together Legal, Compliance, Privacy, InfoSec, R&D, and Product leadership with clear accountability and decision rights.

4. Build measurement into governance from day one. The organizations demonstrating AI ROI embedded KPIs and success metrics into their governance frameworks before first deployment, not after.

The question for 2026 isn’t whether to govern AI—it’s whether your governance will enable competitive advantage or create organizational paralysis. The trends outlined here define the frontier. The institutions that master them will lead. Those that don’t will explain to boards, regulators, and customers why they fell behind. AI governance for Swiss financial services can help you keep a head of of !

What’s your organization’s biggest AI governance challenge? Risk management, compliance alignment, cost control, or innovation enablement? The conversation starts with understanding where you are—and where these five trends are taking your industry.

About Arenema: We partner with Swiss banking, insurance, and biopharma organizations to design and implement AI governance frameworks that enable innovation while managing risk. Our approach integrates regulatory compliance (FINMA, EU AI Act, ISO 42001) with operational excellence, helping leaders turn governance from constraint into competitive advantage.

📅 Book a 30-minute AI Governance Assessment to evaluate your readiness for 2026’s regulatory and competitive landscape: https://calendly.com/bheraly-arenema/30min